Credit Card Processing Pricing Models Explained

Credit card processing fees aren’t random — they’re structured around pricing models that determine how much you actually pay.

Understanding these models helps business owners avoid misleading offers, hidden fees, and long-term overpayment.

WHY PRICING MODELS MATTER

Two businesses can process the same amount of money each month and pay very different fees depending on how their pricing is structured.

The right pricing model depends less on “rates” and more on transaction size, volume, and how customers pay.

FLAT RATE PRICING

INTERCHANGE-PLUS PRICING

TIERED PRICING

DUAL PRICING

FLAT RATE PRICING

Flat-rate pricing charges a single, fixed percentage for most card transactions. The rate remains consistent regardless of card type.

How It Works

This model prioritizes predictability and simplicity. Statements are easy to read, and costs are straightforward to estimate month to month. This is why it’s heavily marketed to new and small businesses.

Real-World Example:

A small retail shop processing $8,000–$12,000 per month with a wide mix of card types may choose flat-rate pricing to keep costs predictable while the business stabilizes.

Who Flat-Rate Pricing Can Make Sense For

New or early-stage businesses

Low to moderate monthly processing volume

Owners who prefer simplicity over optimization

Businesses with inconsistent card types

Bottom line:

Flat-rate pricing prioritizes simplicity, not efficiency.

TIERED PRICING

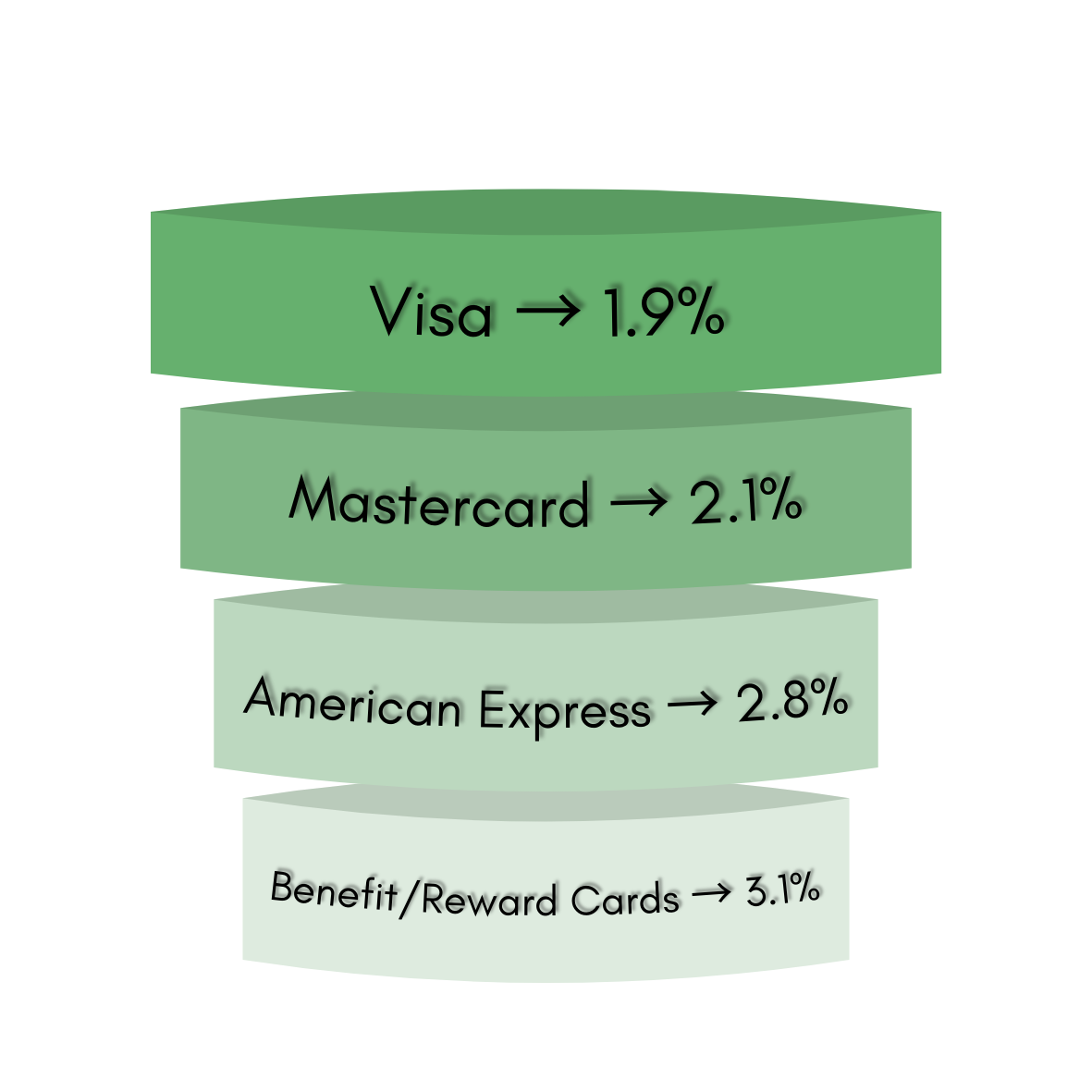

Tiered pricing categorizes transactions into predefined groups, each with its own rate. Transactions are priced based on how they are classified.

How It Works

This model can be effective for businesses that understand their customer base, card mix, and transaction behavior. When transaction types are consistent, tiered pricing can provide structured cost control.

Real-World Example:

A local service business with repeat customers using the same card types and payment methods may find tiered pricing effective when transaction patterns are stable and well understood.

Businesses That Benefit From It

Businesses with a predictable customer card mix

Card-present environments

Owners who actively review statements

Operations with consistent transaction types

Bottom line:

Tiered pricing requires clarity and oversight. Understanding how transactions are categorized is essential for it to work as intended.

INTERCHANGE-PLUS PRICING

Interchange-plus pricing separates the underlying card network cost from the processor’s markup, allowing businesses to see each component clearly.

How It Works

This model emphasizes transparency. Costs vary based on card type, but markups are clearly defined, making it easier to analyze long-term performance.

Real-World Example:

A dealership processing 5 transactions per day at $50,000 per sale benefits from interchange-plus pricing, where transparency and small markup differences have a meaningful financial impact.

Businesses That Benefit From It

Higher average ticket sizes

Lower transaction volume

Businesses focused on long-term cost analysis

Owners who want detailed visibility into fees

Bottom line:

Interchange-plus pricing rewards understanding. It works best when businesses value clarity over simplicity.

DUAL PRICING

Dual pricing separates cash and card pricing, allowing processing costs to be offset while keeping base prices consistent.

How It Works

This model shifts card processing costs transparently while preserving margins, when implemented correctly and compliantly.

Real-World Example:

A quick-service restaurant averaging a $15 ticket and 200 transactions per day may benefit from dual pricing, where small per-transaction fees add up significantly over time.

Businesses That Benefit From It

High-volume, low-ticket businesses

Cash-friendly customer bases

Environments where transaction speed matters

Businesses with strong in-person traffic

Bottom line:

Dual pricing effectiveness depends on proper implementation, customer communication, and compliance.

Choosing the Right Pricing Model

There is no universal “best” pricing model. The right structure depends on:

Average ticket size

Transaction volume

Customer payment behavior

Industry norms

Operational workflow

Choosing based on advertised rates alone often leads to mismatches.

How SaborPay Approaches Pricing

We don’t push a single pricing model.

We evaluate how your business operates, how customers pay, and what structure aligns with your goals.

Our role is to explain each option clearly so you can make an informed decision, without pressure or gimmicks.